Manual KYC processes are costing Indian banks millions in operational expenses and customer acquisition delays. With the average KYC verification taking 7-15 days and involving multiple touchpoints, financial institutions are losing potential customers to competitors who can onboard faster. Recent studies show that 67% of Indian banking customers abandon applications due to lengthy verification processes.

The Reserve Bank of India’s evolving regulations around digital KYC and customer due diligence have created both challenges and opportunities for BFSI organizations. While compliance requirements have become more stringent, technology platforms like ServiceNow are enabling banks to automate KYC processes, reducing verification time from weeks to hours while maintaining regulatory compliance.

This comprehensive guide explores how ServiceNow KYC automation transforms BFSI operations, delivering faster customer onboarding, enhanced compliance, and significant cost savings.

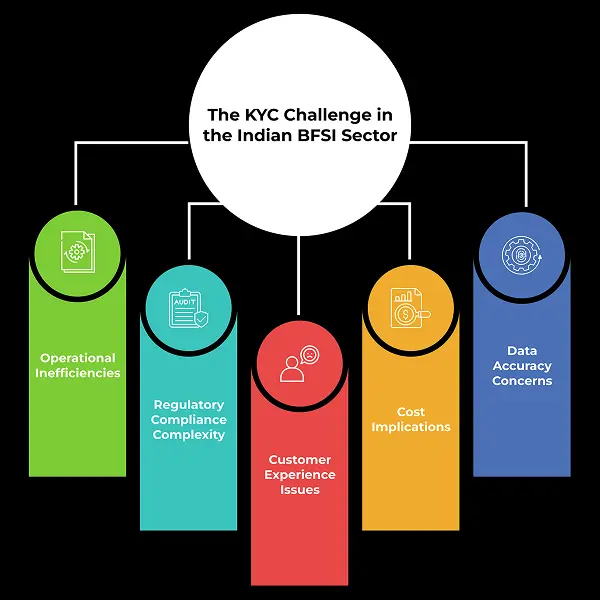

The KYC Challenge in the Indian BFSI Sector

Current Pain Points

Indian financial institutions face mounting pressure to streamline KYC processes while adhering to strict regulatory frameworks. Traditional KYC workflows involve multiple departments, extensive documentation, and manual verification steps that create bottlenecks in customer onboarding.

Key challenges include

Operational Inefficiencies :- Manual document verification and data entry consume significant resources, with the average KYC process requiring 15-20 hours of manual work across different departments.

Regulatory Compliance Complexity :- RBI guidelines mandate comprehensive customer due diligence, politically exposed person (PEP) screening, and ongoing monitoring. Managing these requirements manually increases compliance risks and operational costs.

Customer Experience Issues :- Lengthy verification processes lead to customer dissatisfaction and application abandonment. Studies indicate that 23% of potential customers switch to competitors due to slow KYC processing.

Cost Implications :- Manual KYC processing costs Indian banks approximately ₹800-1,200 per customer application, including staff time, infrastructure, and compliance overhead.

Data Accuracy Concerns :- Manual data entry and verification processes are prone to errors, potentially leading to regulatory violations and financial penalties.

The digital transformation imperative has made KYC process automation not just a competitive advantage but a business necessity for BFSI organizations seeking sustainable growth.

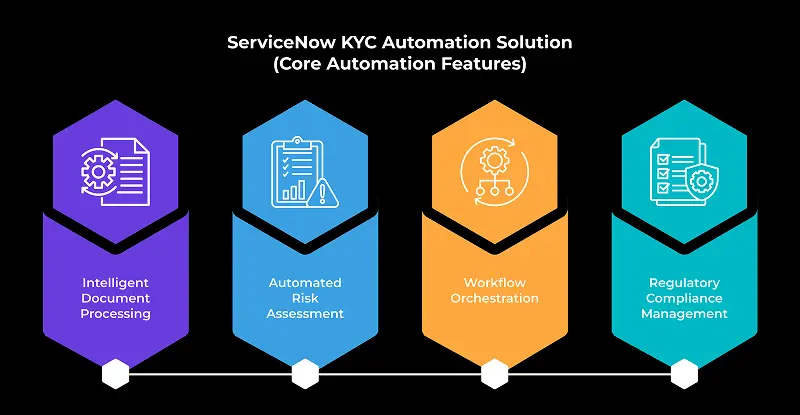

ServiceNow KYC Automation Solution

Platform Capabilities Overview

ServiceNow transforms KYC operations through intelligent automation, workflow orchestration, and integrated compliance management. The platform’s BFSI-specific capabilities address the unique challenges of financial services while ensuring regulatory adherence.

Core Automation Features

Intelligent Document Processing :- ServiceNow’s AI-powered document recognition (DocIntel) automatically extracts and validates information from identity documents, financial statements, and regulatory forms. The system can process various document formats, including Aadhaar cards, PAN cards, and bank statements with 95%+ accuracy*.

*The accuracy may vary depending on the data availability and the training methodologies

Automated Risk Assessment :- The platform integrates with multiple data sources to perform comprehensive risk scoring and PEP screening. Real-time database checks against sanctions lists, adverse media, and regulatory databases ensure thorough due diligence.

Workflow Orchestration :- ServiceNow creates seamless workflows that route cases based on risk levels, document types, and regulatory requirements. High-risk cases are automatically escalated to compliance officers, while low-risk applications flow through expedited processing.

Regulatory Compliance Management :- Built-in compliance frameworks ensure adherence to RBI guidelines, AML regulations, and international standards. The platform maintains comprehensive audit trails and generates regulatory reports automatically.

BFSI-Specific Benefits

Enhanced Customer Experience :- Automated KYC reduces processing time from 7-15 days to 2-4 hours for standard cases. Digital document upload and real-time status updates improve customer satisfaction and reduce abandonment rates.

Scalability and Flexibility :- The platform handles volume fluctuations seamlessly, processing thousands of applications simultaneously without performance degradation. This scalability is crucial for banks experiencing rapid digital growth.

Integration Capabilities :- ServiceNow integrates with existing core banking systems, CRM platforms, and third-party data providers. This connectivity eliminates data silos and ensures consistent information across all touchpoints.

Advanced Analytics :- Real-time dashboards provide insights into processing times, approval rates, and compliance metrics. These analytics enable continuous process optimization and strategic decision-making.

Implementation Essentials

Core Implementation Steps

Phase 1: Assessment and Planning (4-6 weeks) Begin with a comprehensive current-state analysis, identifying existing KYC workflows, pain points, and regulatory requirements. Define automation objectives, success metrics, and integration requirements with existing systems.

Phase 2: Platform Configuration (8-10 weeks) Configure ServiceNow modules for KYC-specific workflows, including document management, risk assessment, and compliance monitoring. Establish integration points with core banking systems and external data sources.

Phase 3: Data Migration and Testing (6-8 weeks) Migrate existing customer data and historical records to the new platform. Conduct comprehensive testing, including unit testing, integration testing, and user acceptance testing, to ensure system reliability.

Phase 4: Training and Deployment (4-6 weeks) Train staff on new workflows and system functionalities. Implement a phased rollout starting with pilot programs before full-scale deployment.

Best Practices for Success

Start with High-Impact Use Cases :- Begin automation with straightforward, high-volume KYC processes such as savings account opening or personal loan applications. This approach delivers quick wins and builds organizational confidence.

Ensure Regulatory Alignment :- Work closely with compliance teams to ensure automated workflows meet all regulatory requirements. Regular reviews and updates maintain alignment with evolving regulations.

Focus on Change Management :- Successful implementation requires comprehensive change management strategies. Engage stakeholders early, provide adequate training, and address concerns proactively.

Maintain Data Quality :- Implement robust data validation rules and quality checks to ensure accurate information processing. Poor data quality can undermine automation benefits and create compliance risks.

Timeline Expectations

Most BFSI organizations achieve meaningful KYC automation within 6-9 months of implementation start. However, full optimization and advanced features may require 12-18 months, depending on system complexity and integration requirements.

Critical success factors include executive sponsorship, dedicated project teams, and phased implementation approaches that allow for continuous learning and optimization.

ROI and Quantifiable Benefits

Operational Efficiency Gains

ServiceNow KYC automation delivers substantial operational improvements that directly impact bottom-line performance:

Processing Time Reduction :- Automated workflows reduce average KYC processing time by 70-80%, enabling faster customer onboarding and improved competitive positioning.

Cost Savings :- Organizations typically achieve a 40-60% reduction in KYC processing costs through automation. For a mid-sized bank processing 10,000 applications monthly, this translates to annual savings of ₹4-6 crores.

Resource Optimization :- Automation frees up skilled staff for higher-value activities such as complex case analysis and customer relationship management.

Compliance and Risk Benefits

Enhanced Accuracy :- Automated data validation and cross-referencing reduce errors by 85-90%, minimizing compliance risks and potential penalties.

Comprehensive Audit Trails :- The platform maintains detailed records of all KYC activities, supporting regulatory examinations and internal audits.

Real-time Monitoring :- Continuous monitoring capabilities identify potential compliance issues before they become problems, enabling proactive risk management.

Customer Experience Improvements

Faster Onboarding :- Reduced processing times improve customer satisfaction and increase conversion rates by 25-35%.

Digital-First Experience :- Mobile-friendly interfaces and digital document submission align with customer expectations for modern banking services.

Transparency :- Real-time status updates and clear communication improve customer trust and reduce service inquiries.

Also Reads :-

Final Thoughts

ServiceNow KYC automation represents a strategic investment in BFSI digital transformation, delivering measurable benefits across operational efficiency, regulatory compliance, and customer experience. The platform’s comprehensive capabilities address the complex requirements of Indian financial institutions while providing scalability for future growth.

Organizations considering KYC automation should begin with pilot implementations focusing on high-volume, standardized processes. This approach minimizes risk while demonstrating value to stakeholders and building organizational capabilities.

Ready to Transform Your KYC Operations?

Contact our ServiceNow specialists to schedule a personalized demonstration and discover how KYC automation can accelerate your digital transformation journey. Our experts will assess your current processes and develop a customized implementation roadmap that delivers rapid ROI while ensuring regulatory compliance.

Schedule your consultation today to join leading BFSI organizations leveraging ServiceNow for competitive advantage in customer onboarding and operational excellence.