Every day, banks and financial institutions in India and the United States face a common challenge: speeding up loan approvals without compromising accuracy, compliance, or customer experience. Lengthy loan processing times — often stretching from 20 to 30 days — frustrate customers and result in lost revenue and missed opportunities for lenders.

But change is happening.

Leading BFSI organizations are adopting ServiceNow workflow automation for BFSI to transform their loan operations. By automating repetitive tasks, streamlining approvals, and using AI to support decision-making, these institutions are cutting loan approval turnaround time by as much as 35%, reducing processing times from weeks to just 48–72 hours.

A major bank reported a 65% reduction in loan processing time after implementing loan processing automation with ServiceNow, while also improving customer satisfaction and reducing compliance burdens.

This isn’t just theory — it’s a proven strategy for BFSI leaders looking to stay competitive in both India and America.

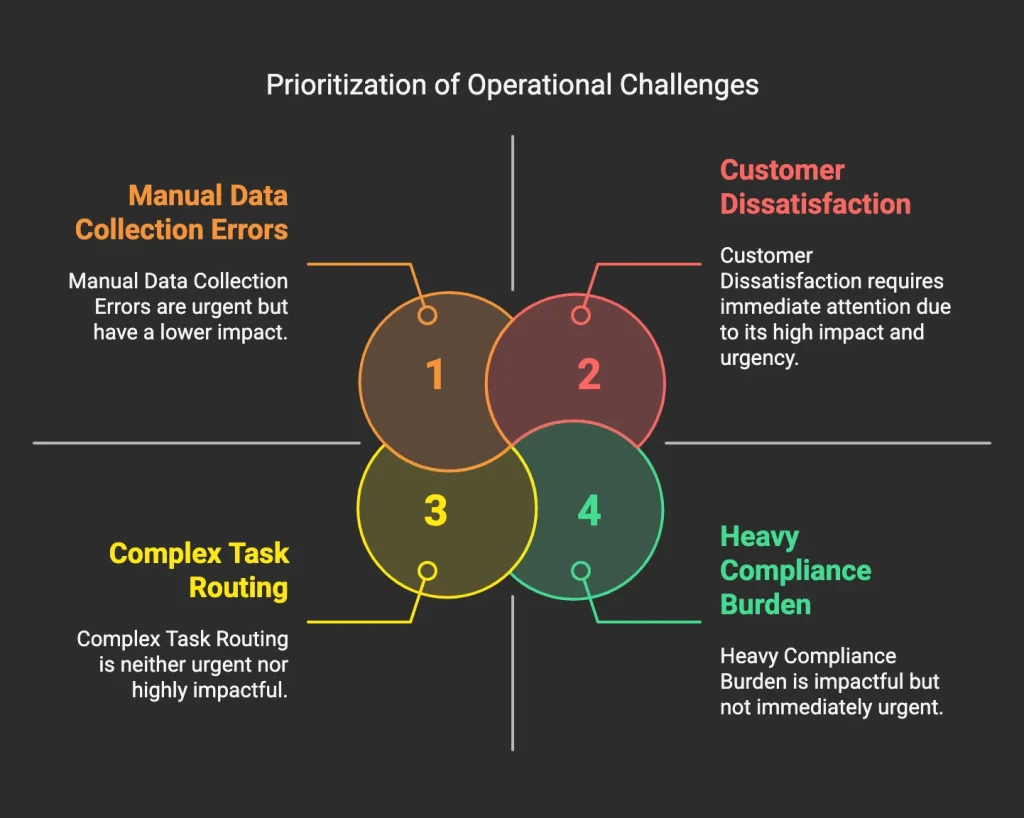

Common Challenges in Traditional Loan Processing

Despite advances in digital banking, many BFSI organizations still rely heavily on manual processes for loan approvals. This leads to several critical pain points:

1. Manual Data Collection Errors

Loan applications involve collecting large amounts of customer data and documentation. When done manually, this process is slow and prone to mistakes like missing or incorrect documents, which delay approvals.

In many Indian banks, loan officers spend hours verifying physical documents and manually entering data, increasing the risk of human error.

2. Complex Task Routing and Approval Delays

Loan approvals require input from multiple departments—credit, risk, compliance, underwriting, and management. Without automation, routing these tasks often results in bottlenecks and missed deadlines.

US regional banks often report delays because approval requests get “lost” in email chains or require multiple follow-ups.

3. Heavy Compliance Burden and Audit Risks

Regulatory bodies in India (like the RBI) and the US (such as the FDIC and OCC) impose strict rules on loan processing. Manual tracking and reporting increase the risk of non-compliance and costly penalties.

4. Customer Dissatisfaction

Long waiting times frustrate customers, leading to poor CSAT scores and lost business to faster competitors, especially fintech startups with digital-first loan solutions.

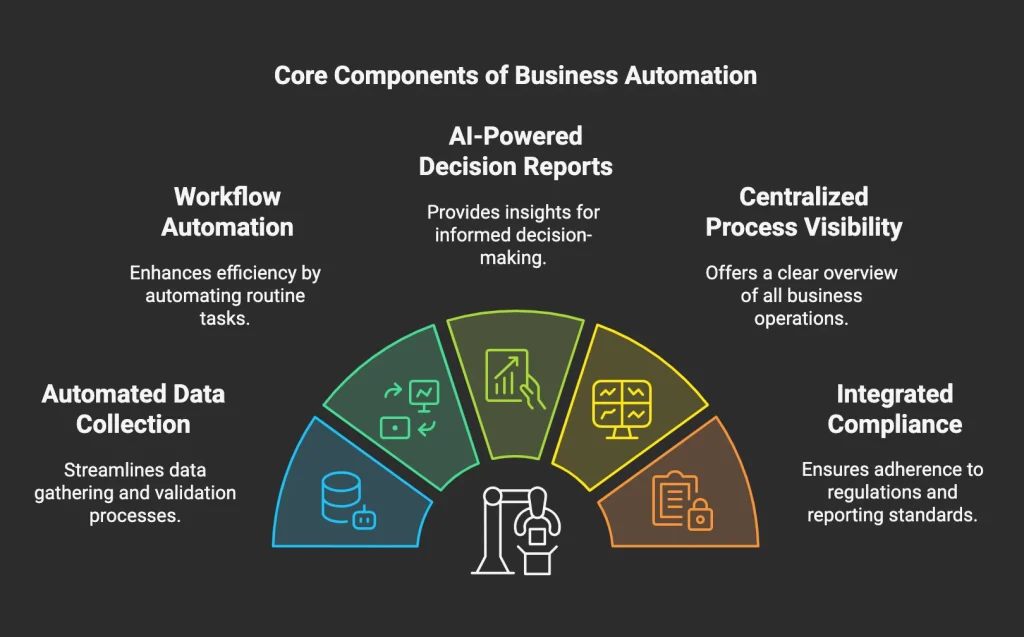

How ServiceNow Workflow Automation Addresses These Pain Points

ServiceNow offers a comprehensive platform designed to automate and optimize loan processing workflows for BFSI institutions, helping banks in both India and the US deliver faster, more accurate, and compliant loan approvals. Let’s explore the key ways ServiceNow workflow automation for BFSI can revolutionize your loan approval process.

1. Automated Data Collection and Verification

Manual data entry and document verification slow down approvals and introduce errors. ServiceNow automates these tasks by integrating with digital identity verification tools, credit bureaus, and document management systems.

- Loan application intake happens automatically as data is pulled in from online forms or third-party sources.

- Intelligent document processing (like DocIntel) extracts and validates documents, flagging missing or inconsistent info instantly.

- This automation reduces human error and accelerates the initial application review stage.

2. Workflow Automation and Task Management

Loan approvals require coordination between various departments — credit, risk, compliance, and management. ServiceNow’s workflow engine automates task routing and approval sequences based on predefined rules.

- Tasks move seamlessly to the right teams without manual intervention.

- Approval reminders and escalations are triggered automatically, preventing bottlenecks.

- Real-time tracking of each loan’s status gives managers clear visibility and control.

3. AI-Powered Decision Reports

Artificial Intelligence enhances decision-making by analyzing applicant data, credit history, and risk factors to generate predictive reports.

- AI models identify high-risk loans or potential fraud early in the process.

- Personalized risk assessments enable quicker, more informed lending decisions.

- This leads to fewer errors and faster loan disbursal.

4. Centralized Process Visibility

A single system of record brings all loan data, tasks, and communications together in one place.

- BFSI leaders gain real-time dashboards showing loan volumes, turnaround times, and compliance status.

- Cross-team collaboration improves as everyone works on the same platform.

- Transparency reduces audit risks and supports faster regulatory reporting.

5. Integrated Compliance and Reporting

ServiceNow automates compliance checks and generates audit trails, simplifying adherence to RBI guidelines in India and FDIC or OCC regulations in the US.

- Compliance tasks are embedded in workflows, ensuring no step is missed.

- Automated reports prepare your team for audits with up-to-date documentation.

- This reduces compliance hassles and the risk of costly penalties.

By automating these critical aspects, ServiceNow enables BFSI lenders to reduce turnaround times by up to 35% and achieve a 65% reduction in loan processing days, all while boosting customer satisfaction through error-free, transparent workflows.

Key Loan Processing Tasks You Can Automate with ServiceNow

Automation is most powerful when applied to repetitive, time-consuming tasks that traditionally slow down loan approvals. Here’s a practical look at six critical loan processing activities that ServiceNow workflow automation for BFSI can streamline:

1. Loan Application Intake and Data Collection

- Automate the collection of customer information and documents from multiple channels — online forms, email, or branch inputs.

- Use intelligent document processing (DocIntel) to scan, extract, and validate documents instantly.

- This reduces manual data entry errors and speeds up the initial application review.

2. Credit and Risk Assessment

- Automatically pull credit reports from bureaus and integrate risk scoring models.

- Use AI-powered decision reports to analyze applicant profiles and highlight potential risks or fraud.

- Streamlines underwriting by providing lenders with clear, actionable insights.

3. Compliance Checks

- Embed regulatory requirements (like KYC, AML, RBI guidelines in India, or OCC rules in the US) into automated workflows.

- Trigger automated checks and flag any non-compliance before moving forward.

- Maintain detailed audit logs for easy reporting.

4. Task Routing and Approval Workflows

- Automatically route applications and documents to the right approvers based on loan amount, risk category, or geography.

- Set automatic reminders and escalation rules to avoid delays.

- Real-time task management enhances accountability and transparency.

5. Loan Disbursement Automation

- Once approved, trigger automated workflows for fund disbursement, notifications, and updating loan accounts.

- Reduce manual handoffs and errors in payment processing.

6. Audit and Reporting

- Generate compliance reports and audit trails automatically for internal reviews and external regulatory requirements.

- Provide management with dashboards showing KPIs like turnaround time, approval rates, and compliance status.

By automating these critical tasks, BFSI institutions can significantly reduce turnaround times, minimize errors, and ensure full regulatory compliance, leading to happier customers and more efficient operations.

Quantifiable Benefits of ServiceNow Workflow Automation in BFSI Loan Processing

1. Reduced Loan Approval Turnaround Time by up to 35%

- By automating data collection, approvals, and compliance checks, lenders cut processing times from an average of 20–30 days down to just 48–72 hours.

- This 35% improvement in turnaround time enables faster customer decisions and improves competitive advantage in the market.

2. 65% Reduction in Overall Loan Processing Time

- End-to-end automation eliminates manual bottlenecks and speeds up every step, reducing the total loan processing cycle by nearly two-thirds.

- Faster approvals mean banks can handle higher loan volumes without adding staff.

3. Enhanced Customer Satisfaction (CSAT)

- Automated workflows minimize errors and delays that frustrate borrowers.

- AI-driven personalization and omnichannel support ensure customers get quick, consistent updates throughout their loan journey.

- BFSI institutions report higher CSAT scores due to smoother, more transparent experiences.

4. Minimized Compliance Hassles and Audit Risks

- Automated compliance checks and real-time reporting reduce the burden of regulatory requirements.

- Detailed audit trails simplify inspections by the RBI (India) and federal regulators (US), reducing penalties and operational risk.

5. Significant Error Reduction

- Automation eliminates manual data entry mistakes, preventing costly loan processing errors.

- AI-powered fraud detection flags suspicious applications early, protecting lenders from financial losses.

6. Improved Operational Efficiency

- Centralized process visibility gives managers clear insights, enabling better resource allocation and quicker issue resolution.

- Task automation frees loan officers to focus on complex, value-added activities rather than routine paperwork.

How BFSI Institutions in India and the US Customize ServiceNow Workflow Automation for Loan Processing

BFSI organizations in India and the United States face different market realities and regulatory landscapes, but both benefit significantly from ServiceNow workflow automation for BFSI tailored to their specific needs.

India: Navigating Regulatory Complexity and High Volume Demand

India’s BFSI sector operates in a fast-growing economy with a large, digitally savvy population. Banks here face:

- Strict Regulatory Compliance: RBI mandates detailed KYC and AML procedures. Indian banks use ServiceNow to automate these compliance checks within loan workflows, reducing human error and ensuring no application advances without fulfilling regulatory criteria.

- High Volume and Diverse Documentation: With customers submitting physical and digital documents from various regions, banks deploy ServiceNow’s automated document processing (DocIntel) to quickly verify and extract critical data, accelerating intake and minimizing delays.

- Centralized Workflow Management: Large banks manage multiple loan types and geographies, leveraging ServiceNow’s centralized dashboards to track application progress, spot bottlenecks, and prioritize approvals efficiently.

United States: Enhancing Customer Experience Amidst Regulatory Demands

In the US, BFSI institutions contend with a highly competitive market where customer expectations are high and compliance is complex:

- Omni-Channel Customer Engagement: US banks integrate ServiceNow workflows to offer seamless loan application experiences via mobile apps, websites, and call centers, ensuring personalized communication and consistent updates.

- AI-Driven Risk Assessment: With tighter federal regulations from agencies like the OCC, banks embed AI-powered decision reports into workflows for faster, data-backed credit risk evaluations.

- Automated Compliance and Reporting: ServiceNow enables easy generation of audit-ready reports that satisfy regulators and reduce the burden on compliance teams.

Real-World Examples

- An Indian private bank slashed loan processing time by 60% using ServiceNow’s automation, freeing staff to focus on customer relationships rather than paperwork.

- A mid-sized US bank boosted customer satisfaction by 40% and cut approval times by over a third, thanks to AI-powered decision workflows and omnichannel support built on ServiceNow.

By tailoring ServiceNow workflow automation for BFSI to their local challenges, institutions in India and the US achieve faster approvals, reduced compliance risk, and better customer experiences.

Best Practices for Implementing ServiceNow Workflow Automation in BFSI Loan Processing

Implementing ServiceNow workflow automation for BFSI can transform your loan approval process, but success depends on thoughtful planning and execution. Here are the key best practices to ensure a smooth, effective rollout that maximizes benefits:

1. Map Your Existing Loan Processes in Detail

2. Prioritize High-Impact Automation Tasks

3. Integrate AI-Powered Decision Support Early

4. Ensure Regulatory Compliance Is Built Into Workflows

Embed compliance rules relevant to your jurisdiction—such as RBI norms for Indian banks or FDIC regulations in the US—directly into automated processes. Automated compliance checks and audit trails reduce risk and simplify reporting.

5. Establish Centralized Dashboards for Real-Time Monitoring

6. Train Teams Thoroughly and Encourage Adoption

7. Plan for Scalable and Flexible Workflow Design

Design workflows that can scale with growing loan volumes and adapt to evolving regulations or business needs. ServiceNow’s platform flexibility enables BFSI organizations to continuously optimize their loan processing automation.

Following these best practices ensures that your investment in ServiceNow workflow automation for BFSI translates into faster loan approvals, enhanced compliance, and improved customer satisfaction in both Indian and American markets.

Future Trends in Loan Processing Automation and How ServiceNow Prepares BFSI for Them

The BFSI sector is evolving rapidly, driven by technological innovation, changing customer expectations, and increasingly complex regulations. To stay competitive, banks and financial institutions in India and the US must embrace emerging trends in loan processing automation, and ServiceNow is uniquely positioned to support this transformation.

1. Expansion of AI and Machine Learning in Decision Making

Future loan processing will rely more heavily on AI and machine learning models that can analyze vast datasets in real time to assess creditworthiness, detect fraud, and personalize customer experiences.

- ServiceNow’s AI-powered decision reports and predictive analytics capabilities will enable BFSI firms to automate complex underwriting and risk assessment tasks with higher accuracy and speed.

2. Hyper-Personalization Through Omnichannel Experiences

Customers expect loan applications to be seamless and personalized across mobile, web, and in-branch channels. Automation platforms will need to integrate data from multiple sources to deliver consistent, tailored experiences.

- ServiceNow’s omnichannel support features provide a unified system of record that ensures customers receive real-time updates and personalized communication, improving engagement and satisfaction.

3. Blockchain and Smart Contracts for Enhanced Security and Transparency

Blockchain technology promises to revolutionize how loan agreements, collateral records, and compliance documentation are stored and verified.

- While still emerging, ServiceNow’s flexible platform is poised to integrate with blockchain-based systems, enabling BFSI organizations to automate secure, transparent workflows that reduce fraud and streamline audits.

4. Regulatory Technology (RegTech) Integration for Real-Time Compliance

Increasingly complex and dynamic regulations require real-time compliance monitoring and automated reporting.

- ServiceNow’s integrated compliance and reporting tools help BFSI institutions keep pace with changing rules from bodies like the RBI and the FDIC, minimizing risk and audit burdens.

5. Increased Focus on Environmental, Social, and Governance (ESG) Criteria

Sustainability and ethical lending are gaining importance globally. Future loan processing automation will incorporate ESG assessments into credit decisions.

- ServiceNow can customize workflows to include ESG data points, helping BFSI firms align lending practices with global sustainability goals.

Preparing for Tomorrow, Today

By adopting ServiceNow workflow automation now, BFSI organizations in India and the US lay a strong foundation for these future trends. The platform’s flexibility, AI capabilities, and comprehensive compliance tools ensure loan processing remains efficient, secure, and customer-centric, no matter how the industry evolves.

Also Reads:

1. Revolutionizing Motor Insurance with ServiceNow – AI & Workflow Automation for Claims Processing

Final Thoughts

The BFSI landscape is changing at a rapid pace. Reducing loan approval turnaround time while ensuring compliance and enhancing customer satisfaction is critical. ServiceNow workflow automation empowers banks and financial institutions in India and the US to streamline loan processing, minimize errors, and stay ahead of regulatory demands.

By leveraging AI-driven decision support, automated task management, and centralized visibility, BFSI organizations can achieve measurable improvements in efficiency and customer experience.

As a trusted ServiceNow partner, LMTEQ specializes in implementing customized workflow automation solutions tailored to your unique loan processing challenges. Whether you are looking to accelerate approvals, improve compliance, or enhance customer engagement, LMTEQ can help you unlock the full potential of ServiceNow.

Contact us today to learn how LMTEQ can transform your BFSI loan processing with ServiceNow automation.