Where Your Fintech Meets Our Innovation

Traditional banks are under pressure to rapidly evolve into digitally advanced “banks of the future.” This emphasizes the necessity for intricate technology strategies rooted in customer obsession to enable exceptional adaptability, creativity, and resilience. Integrating LMTEQ’s ServiceNow Finance Service accelerates this transformation. Our service streamlines financial operations, processes account requests and manages customer relationships with transparency, accuracy, and efficiency. Adopt to future-fit strategy with LMTEQ’s ServiceNow Finance service and meet the heightened expectations of your customers

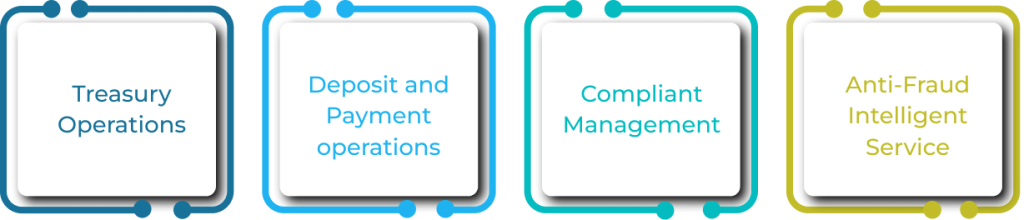

Your Key to Banking Brilliance Starts with LMTEQ’s ServiceNow Finance Service