Unifying IT and Non-IT Asset Visibility for 100+ Branches at a Leading Indian Bank Using ServiceNow for Banking

80%

Reduction in MTTR(Incident)

96%

Asset Accuracy

90%

Infra Downtime Root Cause Clarity

An Overview

A top private bank in India, with a massive network of 100+ branches and a rapidly growing digital footprint, was facing infrastructure blind spots that impacted service uptime, audit readiness, and inter-departmental coordination. Our team stepped in with a hybrid CMDB strategy, custom connectors, and cross-functional automation built on the ServiceNow platform.

Within 6 months, the bank moved from fragmented, siloed asset management to a single pane of glass visibility across its IT and facility landscape, leading to a 96% accurate asset registry, 3x faster incident resolution, and 80% fewer audit escalations.

The Client

- One of India’s top 5 private sector banks

- Over ₹15 lakh crore in total assets

- 100+ branch locations across urban and rural India

- 24×7 digital services: core banking, mobile apps, ATMs, call centers, trade finance

- Heavy reliance on both IT systems (routers, servers, endpoints) and non-IT infra (power backup, HVAC, CCTV, door controls)

Challenges – Fragmented Infrastructure, High Risk Operations

Siloed Systems

- ITSM is managed by internal teams on legacy tools

- Facility Assets managed regionally via spreadsheets, emails, or vendor portals

- No single system to correlate UPS failure with router crash or HVAC downtime with server overheating

Zero Visibility During Critical Incidents

- During a flood incident in a Tier 2 branch, power was lost, the backup UPS failed, and the ATM went offline

- IT teams raised multiple incidents, but had no idea the real issue was a local UPS fault

- Customers suffered; branches stayed shut; top management had no single dashboard showing what broke where

Audit and Compliance Gaps

- RBI-mandated infra documentation was incomplete

- No structured logs for surveillance systems, access control audits, generator usage, or fire safety equipment

- Risk and Compliance teams spent weeks manually collecting data for inspections

LMTEQ Engagement: Discovery-Led Consulting Approach

Step #1 – Discovery Workshops

LMTEQ conducted detailed sessions with:

- Central IT Ops

- Regional Infra Heads

- Internal Audit and Compliance

- Service Desk Managers

Key findings:

- The bank used 10+ disconnected tools to manage infra

- 50% of branch incidents had unclear root causes due to missing visibility into non-IT assets

- 20+ RBI audit escalations in the previous year were linked to incomplete or incorrect inventory data

Step #2 – Data Assessment and CMDB Planning

We performed a maturity check on:

- Existing CMDB (only IT assets partially configured)

- Discovery tools (none for facilities equipment)

- Integration feasibility with BMS, CCTV consoles, vendor portals

Proposed Solution Architecture

CMDB Restructuring

- Generators (diesel + solar)

- UPS and inverters

- Air conditioning units (critical for server rooms)

- Fire suppression systems

- Access control and biometrics

- CCTV and video surveillance units

Data Integration and Discovery

- Used Service Graph Connectors for IT devices

- Built custom MID Server scripts to ingest:

- BMS data (power/cooling usage per branch)

- CCTV firmware status via vendor APIs

- Access logs from biometric systems

- Pulled static data from 12 spreadsheets + 3 vendor portals

- Created branch-level relationship maps:- Generator → UPS → Router → Core Banking App

Visualization and Mapping

- Configured ServiceNow Service Mapping for:

- ATM services per branch

- CRM and loan processing systems

- Mobile banking backend

- Linked IT services to physical infrastructure (power, cooling, access control)

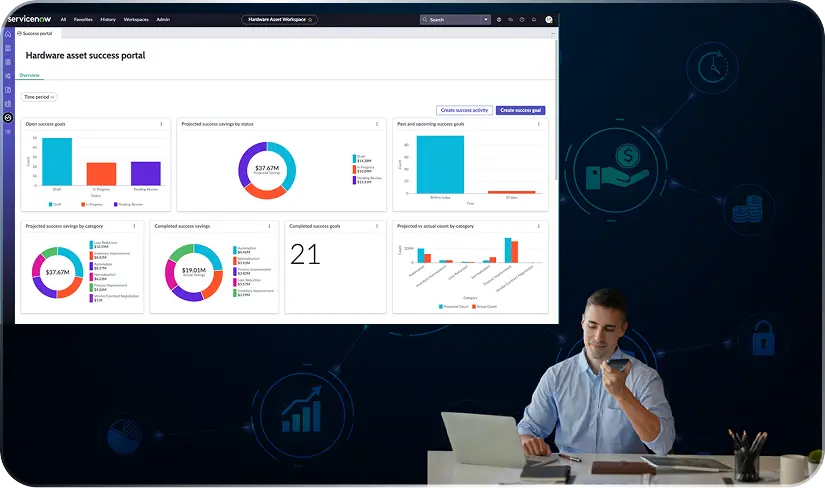

- Implemented health dashboards to monitor:

- Infra health score per branch

- Critical asset uptime & warranty status

- Incident volume trends vs. infra faults

Event Management and Alerting

- BMS + CCTV feeds triggered ServiceNow incidents automatically

- Applied Event Rules to:

- Route cooling failure alerts to infra teams

- Escalate power loss linked to ATM downtimes

- Notify the compliance team if biometric access control fails in secure zones

Cross-Team Workflows

- Created bi-directional workflows between:

- IT Support → Infra Field Engineers

- Audit Team → Branch Operations

- Vendor Technicians → ServiceNow Tasks with SLAs

Business Outcomes

| KPI | Before LMTEQ | After the ServiceNow Deployment |

|---|---|---|

| Asset Accuracy (IT + Non-IT) | ~45% | 96% |

| Infra Downtime Root Cause Clarity | greater than 30% cases | 90% of cases |

| Compliance Audit Escalations | 20+ / year | greater than 5 / year |

| Incident MTTR (Infra + IT) | Avg. 8 hours | Avg. 3 hours |

| Cross-Team Coordination Time | Days | greater than 6 hours |

| Dashboard Visibility | Manual Excel reports | Real-time, role-based dashboards |

Scenario – ATM Outage at Tier 3 Branch

| Step | Before LMTEQ | After LMTEQ (ServiceNow) |

|---|---|---|

| Alert Trigger | Manual call from the branch | Auto-alert from the BMS system |

| Root Cause | Unknown, assumed network issue | UPS failure → Router offline |

| SLA Breach | Yes (T+2) | No (Resolved same day) |

| Escalation Time | Less than 1 Day | 15 minutes |

What the Client Said

— Group Head – Enterprise Infrastructure & Audit, Leading Private Bank, India

What’s Next?

- Field Service Automation – Assigning technicians to faulty infrastructure based on alerts

- Predictive Intelligence – Identify likely future branch outages based on past patterns

- Asset Lifecycle Automation – Auto-initiate procurement or replacement before failure

Key LMTEQ Differentiators

- Deep BFSI infra domain understanding

- Preferred ServiceNow Partner in India

- Ability to extend CMDB beyond out-of-the-box classes

- Built secure, compliant, and audit-ready asset data pipelines

- Designed for scalability, from 200 pilot branches to 3000+ in 4 months

- Delivered value without replacing existing vendor systems, only integrated them