of CMDB coverage

of Critical Data Assets mapped

regulatory audit passed

A prominent Indian bank, operating under stringent RBI guidelines, partnered with LMTEQ to initiate a multi-phase data center modernization using ServiceNow.

The objective :- Achieve full visibility of IT and non-IT assets across their distributed data centers, build a compliant CMDB, and lay the foundation for integrated, real-time monitoring.

The bank had previously implemented ServiceNow ITSM and ITOM, including Problem, Change, and Knowledge modules. However, they lacked a robust ServiceNow Discovery strategy for BFSI and faced integration barriers due to regulatory constraints.

Our Phase 1 implementation focused on enabling secure discovery, ensuring CMDB visibility in banking with ServiceNow, and enabling scheduled maintenance tracking in ServiceNow to support RBI audit readiness.

This case study highlights how ServiceNow solutions for banking can be adapted for complex, compliance-driven modernization efforts in the financial sector.

The client is a nationally recognized bank in India with a footprint across thousands of branches and multiple high-availability data centers. Their operations span retail banking, treasury, wealth management, and fintech services, all of which rely on uninterrupted digital infrastructure.

While the bank had begun its ServiceNow journey, it lacked centralized control over data center components such as UPS systems, HVAC, chillers, and backup generators, assets critical to service uptime.

With regulatory policies from the RBI restricting direct integrations (such as REST, SOAP, SSH), the bank sought a partner with deep experience in ServiceNow for RBI-compliant banks to implement a scalable and compliant CMDB.

Due to RBI policies, conventional discovery methods involving direct API calls or remote access (SSH, SNMP, etc.) were either disallowed or highly restricted. This posed challenges for any ServiceNow Discovery for BFSI initiatives.

Maintenance schedules and SLAs for physical assets were scattered across tools and email chains. Without structured processes, the bank lacked scheduled maintenance tracking in ServiceNow, increasing the risk of outages and audit violations.

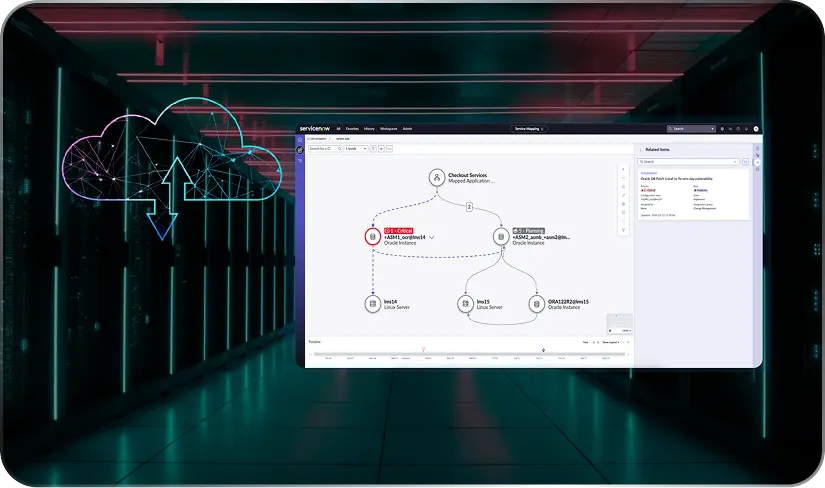

With no relationships defined between infrastructure components and banking services (like loan processing or ATM uptime), the bank had no way to calculate impact or prioritize fixes, limiting their ability to fully adopt ServiceNow for data center management.

LMTEQ’s Phase 1 rollout was centered around three pillars: compliant discovery architecture, custom CMDB schema for BFSI infrastructure, and maintenance integration.

To enable ServiceNow Discovery for BFSI without violating regulatory constraints:

This compliant model ensured data center asset visibility through ServiceNow, while adhering to RBI audit frameworks.

The CMDB was tailored to support a true banking infrastructure modernization model:

This implementation ensured CMDB visibility in banking with ServiceNow, unlocking future use cases in monitoring and compliance reporting.

To address gaps in maintenance planning, we implemented:

As a result, the client gained visibility into both scheduled and overdue maintenance, improving asset reliability.

With Phase 1 completed, the bank is preparing to move toward real-time monitoring and automation:

Through this phased approach, we are helping the client achieve true ServiceNow data center modernization while staying fully aligned with RBI norms.

If your bank is struggling with limited asset visibility, disconnected maintenance records, or compliance challenges, LMTEQ can help you implement secure, scalable, and regulator-friendly ServiceNow solutions for banking.